Global Microcontroller Market: Market analysis (2025)

Olesandro Fanasmann

Electronic Product Designer / Mechatronics Engineer / PCB and Mechanical Design Engineer / ECAD-MCAD

May 1, 2025

This document is designed to:

Engineers who choose a platform for their developments

Business analysts tracking industry trends

Investors interested in understanding market dynamics

Manufacturers formulating their strategic plans

While developing this review, I tried to assess the microcontroller market truthfully and accurately.

But I do not guarantee maximum accuracy, as I am human and can also make mistakes or inaccuracies.

I apologize for this and hope that you will appreciate this work.

Executive Summary

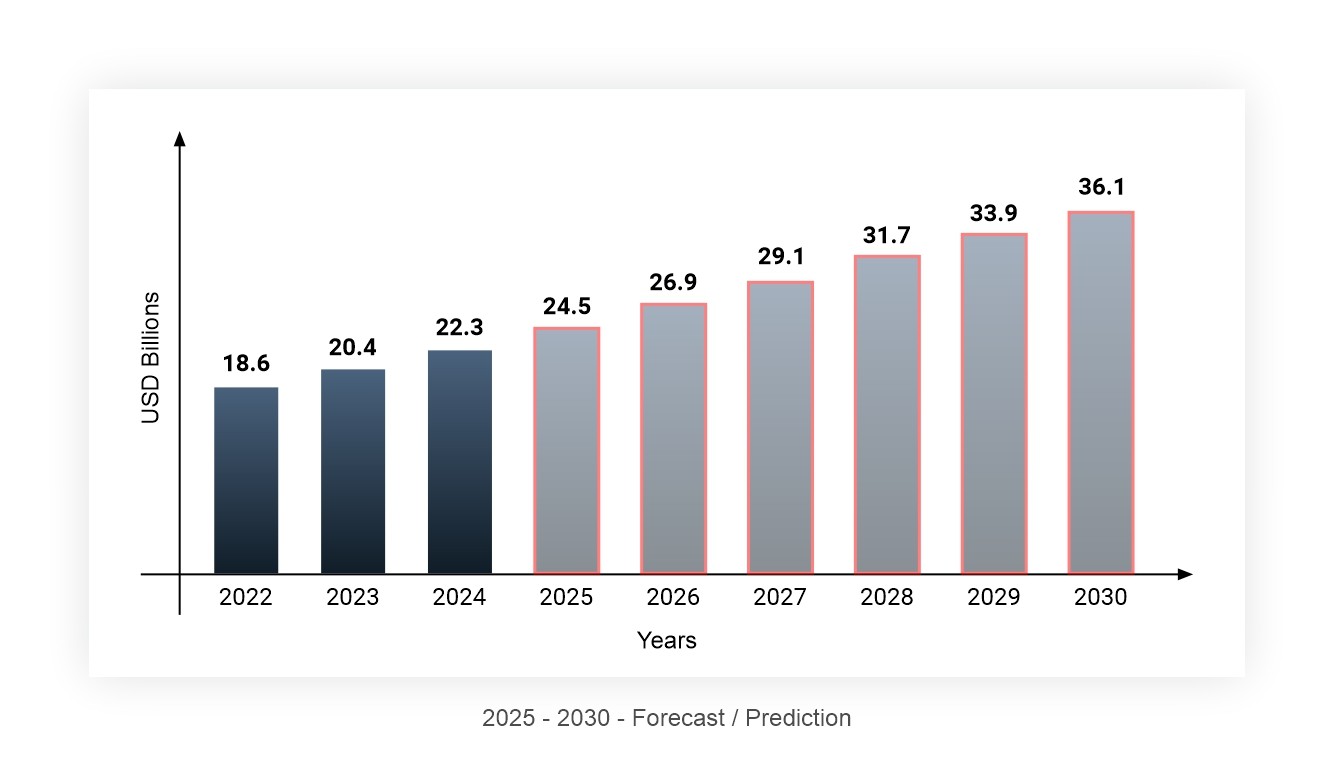

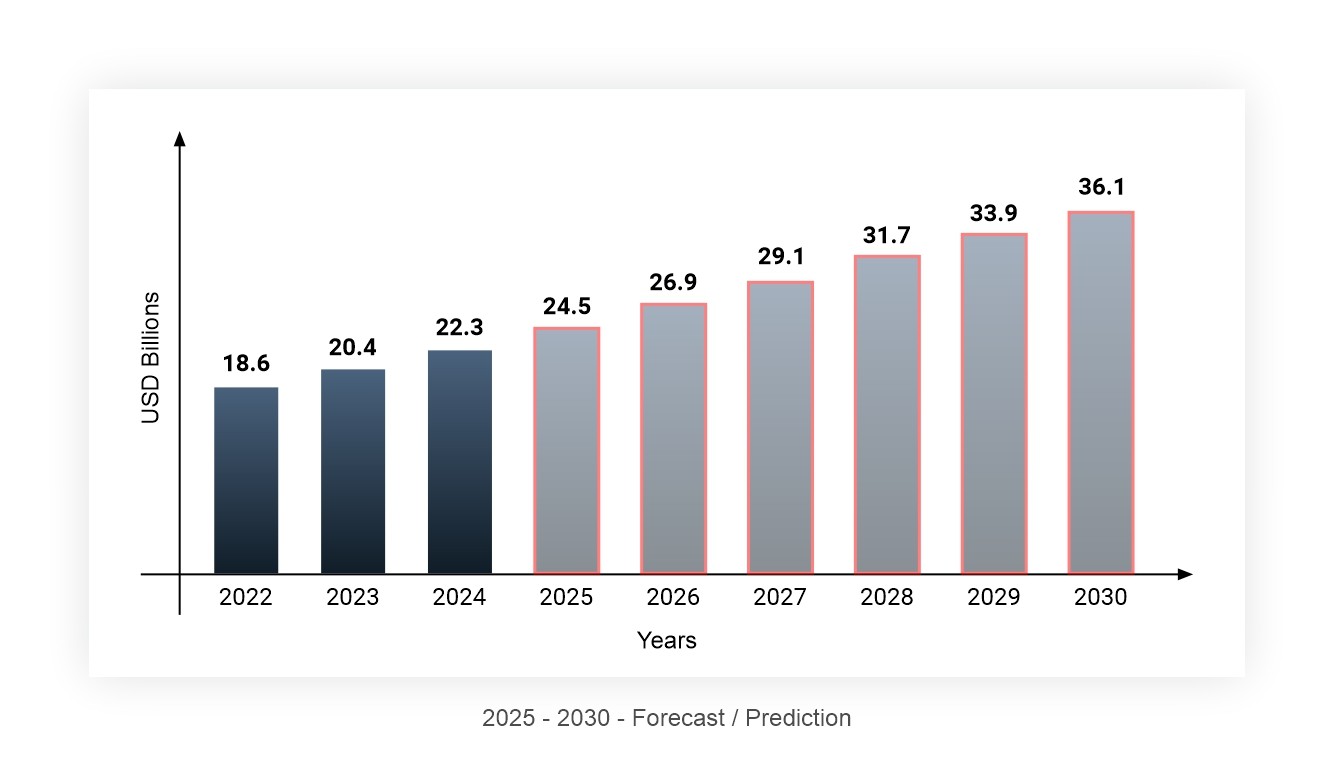

The global microcontroller (MCU) market reached $22.3 billion in 2024, with a projected CAGR of 8.4% through 2030, driving the market to an estimated $36.1 billion by the end of the forecast period (IC Insights, 2024). This growth is fueled by increasing demand across automotive, industrial IoT, and consumer electronics sectors, alongside the emergence of edge AI applications.

Key market dynamics include:

Architectural Evolution: ARM Cortex-M dominates with 65% market share, but RISC-V is experiencing the fastest growth (projected to reach 14-18% by 2030)

Regional Dynamics: Asia-Pacific leads in volume (53% of global shipments), while North America and Europe command higher ASPs

Consolidation Trends: Continued mergers and acquisitions reshaping the competitive landscape

Supply Chain Challenges: Semiconductor shortages continuing to affect lead times and pricing, with regional diversification becoming a strategic priority

Technological Shifts: Ultra-low power, edge AI, enhanced security, and wireless connectivity becoming standard requirements

Market Size and Growth Analysis

Global MCU Market Overview

Global MCU Market Size (USD Billions)

Market Segmentation by Application (2024)

CAGR (2024-2030)

Automotive - CAGR - 11.2%. Key Growth Drivers - ADAS, electrification, digital cockpits

Industrial - CAGR - 9.5%. Key Growth Drivers - Industry 4.0, automation, digital twins

Consumer - CAGR - 6.7%. Key Growth Drivers - Smart home, wearables, AR/VR devices

Communications - CAGR - 7.3%. Key Growth Drivers - 5G infrastructure, IoT gateways

Medical - CAGR - 10.5%. Key Growth Drivers - Remote monitoring, wearable health devices

Others - CAGR - 5.2%. Key Growth Drivers - Security, aerospace, military applications

Source: Omdia Microcontroller Market Tracker (2024)

MCU Unit Shipments by Architecture (2024-2030)

MCU Architecture Market Share (2024)

Projected MCU Architecture

Market Share (2030)

"ARM Cortex-M" : 58

"8/16-bit" : 10

"RISC-V" : 27

"Others (MIPS, Proprietary)" : 5

Source: Semico Research Corporation (2024), SHI Consulting MCU Market Report (2024)

Average Selling Price (ASP) Trends

| MCU Category |

2022 ASP |

2024 ASP |

2026(e) ASP |

Key Factors |

| 8-bit |

$0.42 |

$0.47 |

$0.50 |

Supply constraints, legacy demand |

| 16-bit |

$0.65 |

$0.73 |

$0.77 |

Industrial applications, limited competition |

| 32-bit (Basic) |

$0.82 |

$0.94 |

$0.98 |

IoT growth, increased competition |

| 32-bit (Advanced) |

$2.17 |

$2.36 |

$2.44 |

Feature integration, security capabilities |

| Automotive-Grade |

$3.85 |

$4.28 |

$4.52 |

Safety certification, reliability requirements |

| AI-Enabled |

$3.25 |

$3.59 |

$3.67 |

Edge processing capabilities, specialized hardware |

Regional Market Analysis

Regional Market Share (Revenue, 2024)

| Region |

Revenue |

Unit Share |

ASP |

Key Trends |

| Asia-Pacific |

45% |

53% |

Lower |

Manufacturing powerhouse, domestic consumption |

| North America |

26% |

19% |

Higher |

High-value applications, R&D leadership |

| Europe |

23% |

17% |

Higher |

Automotive, industrial automation strength |

| Rest of World |

6% |

11% |

Lower |

Growing embedded systems adoption |

Regional Manufacturing Capacity

| Region |

Share of Global MCU Production (2024) |

Projected Share (2030) |

Government Initiatives |

| Taiwan |

38% |

32% |

Taiwan Semiconductor Resilience Act |

| China |

16% |

26% |

"Made in China 2025," $150B Semiconductor Fund |

| Europe |

15% |

18% |

EU Chips Act (€43B investments) |

| USA |

13% |

17% |

CHIPS Act ($52B funding) |

| Japan |

11% |

8% |

¥800B subsidy program |

| South Korea |

5% |

7% |

K-Semiconductor Strategy |

| Others |

2% |

2% |

Various local initiatives |

Supply Chain Analysis and Challenges

Key Supply Chain Dynamics

The MCU supply chain continues to face significant challenges and transformations:

Lead Time Trends: Average lead times decreased from 42 weeks (2022 peak) to 18 weeks (2024), but remain above pre-pandemic levels (IC Insights, 2024)

Foundry Concentration: Top 5 foundries (TSMC, GlobalFoundries, UMC, SMIC, Tower/Intel) account for 87% of MCU manufacturing capacity

Materials Constraints: Substrate and packaging material shortages persist, particularly for advanced MCUs with larger die sizes

Regional Diversification: "China+1" strategy being implemented by 73% of MCU manufacturers, with increasing investments in USA, Europe, and Southeast Asia

Inventory Management: OEMs holding 2-3x higher inventory levels (8-12 weeks vs. 3-4 weeks pre-pandemic) to mitigate supply risks

Geopolitical Impact Assessment

html

| Factor |

Impact |

Affected Companies |

Market Response |

| US Export Controls |

Severe limitations on Chinese access to advanced processing technologies |

HiSilicon, SMIC, Unisoc |

Acceleration of domestic Chinese R&D, focus on mature nodes |

| EU Chips Act |

€43B investment to double European semiconductor production by 2030 |

STMicroelectronics, Infineon, NXP |

Expanded European manufacturing capacity, focus on automotive and industrial MCUs |

| CHIPS Act (USA) |

$52B in subsidies for domestic semiconductor manufacturing |

Texas Instruments, Microchip, GlobalFoundries |

New fabs, expanded capacity for advanced MCUs |

| China's Semiconductor Fund |

$150B+ investment in domestic semiconductor industry |

GigaDevice, Huada, WCH |

Rapid growth in RISC-V adoption, increased self-sufficiency |

| Taiwan-China Tensions |

Concerns about TSMC concentration risk |

All fabless companies |

Geographic diversification of manufacturing |

| Russia-Ukraine War |

Disruption in neon gas and other raw materials |

All manufacturers |

Alternative sourcing, price increases |

Major Players by Region

Asia (37 companies)

China (24 companies)

ARTERY (Mid-range, ARM Cortex-M, Fabless, Consumer/Industrial)

Actions Technology (Budget, proprietary SoC for audio/video, Fabless, Consumer) [Note: primarily SoC rather than traditional MCU]

AllWinner Technology (Budget, ARM-based SoC for tablets/TV boxes, Fabless, Consumer) [Note: primarily SoC rather than traditional MCU]

Beken Corporation (Mid-range, WiFi/BLE MCUs, ARM Cortex-M, Fabless, IoT/Consumer) [Note: BK72xx series competes with Espressif in the WiFi/BLE MCU segment; gaining traction in smart home devices]

Bouffalo Lab (Budget/Mid-range, Ultra-low-power RISC-V for IoT, Fabless, IoT/Consumer) [Note: emerging player specializing in RISC-V WiFi/BLE solutions with BL60x/BL70x/BL80x series; BL808 features triple-core design (LP/HP+NPU)]

BYD Microelectronics (Mid-range, primarily IGBT with limited MCU offerings, IDM, Industrial/Automotive) [Note: MCUs primarily based on PowerPC/ARM for BYD vehicles and in-house EV production, minimal presence in open market]

CHIPSEA (Budget, ARM Cortex-M, Fabless, Industrial/Consumer)

Eastsoft (Budget/Mid-range, ARM Cortex-M, Fabless, Industrial/Consumer) [Note: focuses on industrial control and smart home applications]

Espressif Systems (Mid-range, WiFi/BT MCUs, RISC-V/Xtensa, Fabless, IoT) [Note: ESP32-C/H/S series use RISC-V architecture; ESP32-P4 introducing first RISC-V vector extensions (V-extension) for AI acceleration; dominant player in WiFi-enabled MCUs with comprehensive software ecosystem]

FUDAN MICRO (Budget, 8-bit/ARM, Fabless, Industrial/Consumer)

Geehy (Budget, ARM Cortex-M APM32, Fabless, Industrial/Consumer)

GigaDevice (Budget/Mid-range, SPI Flash and GD32 MCUs, ARM/RISC-V, Fabless, Industrial/IoT) [Note: GD32V series uses RISC-V architecture; direct competitor to STM32; GD32 MCUs are often binary-compatible with STM32, facilitating migration; reported 350M+ units shipped and 14% China market share in 2023]

HiSilicon (Premium, ARM-based SoC, Fabless, minimal presence in open MCU market due to export controls) [Note: focuses on SoCs for Huawei's internal use]

Huada Semiconductor (Mid-range, HC32 series MCUs, ARM Cortex-M, Fabless, Industrial/Consumer) [Note: HC32 series positioned as alternative to STM32 with similar peripheral sets and compatibility; focused on domestic Chinese market]

Ingenic (Budget, MIPS/RISC-V SoC, Fabless, Consumer/IoT)

MindMotion Microelectronic (Budget, ARM Cortex-M, Fabless, Industrial/Consumer)

PUYA (Budget, Memory and MCUs, ARM Cortex-M, Fabless, Consumer/IoT)

Rockchip (Mid-range, ARM-based SoC for tablets/TV boxes/AIoT, Fabless, Consumer) [Note: primarily SoC rather than traditional MCU]

Sino Wealth (Budget, 8051/ARM-based MCUs, Fabless, Consumer) [Note: SH88F (8-bit) and SH32F series (ARM Cortex-M0/M3) popular in low-cost consumer electronics and USB devices]

SOC (Shenzhen SinOne Micro) (Budget, 8-bit proprietary, Fabless, Consumer)

STC Micro (Budget, 8051-compatible MCUs, Fabless, Industrial/Consumer)

Telink Semiconductor (Budget, Wireless MCUs, proprietary RISC, Fabless, IoT)

Unisoc (Spreadtrum) (Mid-range, RISC-V MCUs for IoT/wireless, Fabless, Consumer/IoT) [Note: primarily known for mobile SoCs but expanding into IoT MCUs with RISC-V architecture]

WCH (Jiangsu Qin Heng) (Budget, USB interfaces and RISC-V MCUs, Fabless, Consumer/IoT) [Note: CH32V series used as low-cost RISC-V alternative to STM32; leveraging export control exemptions to gain domestic market share]

Taiwan (6 companies)

ELAN Microelectronics (Mid-range, ARM Cortex-M/proprietary, Fabless, HMI/Consumer)

Holtek Semiconductor (Budget/Mid-range, 8-bit/ARM, Fabless, Consumer/Industrial)

MediaTek (Mid-range/Premium, ARM-based SoC for smartphones/TV/IoT, Fabless, Consumer) [Note: primarily SoC rather than traditional MCU]

Megawin Tech (Budget, 8-bit/ARM, Fabless, Industrial/Consumer)

Nuvoton Technology (Mid-range, ARM/8051, includes former Panasonic and Winbond MCUs, IDM, Industrial/Consumer) [Note: NuMicro series covers wide range of applications; reported 8% market share in Taiwan/ASEAN region]

PADAUK Tech (Budget, OTP MCUs, proprietary, Fabless, Consumer) [Note: notable for ultra-low-cost OTP (One-Time Programmable) MCUs under $0.10, popular in disposable consumer electronics and toys; shipped over 1 billion units in 2023]

Japan (4 companies)

ROHM Semiconductor (Mid-range, ARM/proprietary, IDM, Industrial/Automotive)

Renesas Electronics (Premium/Mid-range, ARM/proprietary, includes IDT, Dialog Semiconductor, IDM, Industrial/Automotive) [Note: RA series for IoT with quantum-resistant security features, RA8M1 being the first Cortex-M85 MCUs with Helium AI extensions and 2.5MB SRAM + 2MB flash for AI workloads, RA4 series for ultra-low power (35μA/MHz), RX for general-purpose, RH850 for automotive; acquired Dialog Semiconductor in 2021; holds approximately 30% of automotive MCU market]

Seiko Epson (Mid-range, Energy-efficient MCUs, proprietary/ARM, IDM, Industrial)

Toshiba (Premium/Mid-range, ARM/MIPS-based TMPM/TXZ series, IDM, Industrial/Automotive) [Note: significant player in industrial and automotive MCU markets]

South Korea (3 companies)

ABOV Semicon (Mid-range, 8-bit/ARM, Fabless, Industrial/Consumer)

Samsung Electronics (Premium, ARM-based, IDM, primarily for internal use with limited external market offerings, Consumer/Industrial)

WIZNET (Mid-range, Network-focused MCUs with TCP/IP hardware, Fabless, IoT/Industrial) [Note: specialized in Ethernet controllers with MCU functionality (W5500 series); provides hardwired TCP/IP for simplified networking implementation]

North America (10 companies)

USA (10 companies)

Ambiq (Mid-range, Ultra-low power, ARM Cortex-M, Fabless, IoT/Wearables) [Note: specializes in sub-threshold computing for ultra-low-power applications; Apollo series sets benchmarks in energy efficiency with 6μA/MHz operation; raised $225M in funding to date]

Analog Devices (ADI) (Premium, includes Maxim Integrated, ARM/proprietary, IDM, Industrial/Automotive) [Note: acquired Maxim Integrated in 2021 for $21B, expanding MCU portfolio with strong analog integration; holds approximately 7% of global MCU market share]

Diodes Incorporated (Mid-range, ARM Cortex-M, Fabless, Industrial/Consumer) [Note: smaller player focusing on integrated power management and connectivity solutions]

Lattice Semiconductor (Mid-range, FPGA with MCU functionality, ARM/RISC-V, Fabless, Industrial/IoT) [Note: specializes in small, low-power FPGAs often combined with MCU cores; Nexus platform enables edge AI applications with embedded processors]

Microchip Technology (Mid-range/Premium, includes Atmel, ARM/PIC/AVR, IDM, Industrial/Automotive/Consumer) [Note: PIC series for 8/16-bit, AVR from Atmel acquisition, SAM series for 32-bit ARM-based solutions; comprehensive portfolio across all segments; holds approximately 12% of global MCU market share, with leading position in 8-bit segment]

Morse Micro (Mid-range, WiFi HaLow (802.11ah) MCUs, ARM Cortex-M, Fabless, IoT) [Note: specialized in long-range, low-power WiFi HaLow solutions for IoT applications with MM6108 series offering 1km+ range]

onsemi (Mid-range, Power electronics with some MCU lines, ARM, IDM, Industrial/Automotive) [Note: strong focus on power-efficient MCUs for automotive and industrial applications]

Parallax (Mid-range, Propeller MCUs for education, proprietary, Fabless, Education/Hobbyist) [Note: niche player with limited market share; focused on educational market; Propeller P8X32A multicore architecture with 8 cores (cogs) for parallel processing]

Silicon Labs (Mid-range/Premium, MCUs for IoT and wireless communications, ARM, Fabless, IoT/Industrial) [Note: specialized in wireless connectivity MCUs; strong ecosystem for IoT applications with comprehensive Simplicity Studio tools and wireless stacks (Zigbee, Thread, Bluetooth); holds approximately 4% of global MCU market]

Texas Instruments (TI) (Premium/Mid-range, ARM/MSP430, IDM, Industrial/Automotive/Consumer) [Note: MSP430 for 16-bit applications, Tiva/Hercules/SimpleLink for 32-bit ARM solutions; comprehensive analog and power integration; holds approximately 17% of global MCU market, with leading position in industrial segment]

Europe (9 companies)

France (1 company)

GreenWaves Technologies (Mid-range, GAP processors based on RISC-V, Fabless, IoT/Edge AI) [Note: specializes in ultra-low power TinyML processors for edge AI applications; GAP8/GAP9 series combine RISC-V cores with specialized accelerators; raised €34M in funding to date]

United Kingdom (3 companies)

FTDI (Mid-range, USB interfaces with integrated MCUs, proprietary, Fabless, Industrial/Consumer) [Note: known primarily for USB bridges; FT32 series is a relatively niche MCU offering]

Raspberry Pi (Budget, RP2040 MCU, ARM Cortex-M, Fabless, Education/Hobbyist) [Note: single product offering (RP2040) manufactured by TSMC on 40nm process that has gained widespread adoption in maker/education markets; over 4 million units shipped since 2021 launch]

XMOS (Premium, Multi-core audio-focused processors, proprietary, Fabless, Audio/Industrial) [Note: xCORE architecture specialized for real-time audio processing and voice interfaces; xCORE-200 series with 16 cores for real-time DSP; not traditional MCUs but real-time multicore processors for audio/voice applications]

Netherlands (1 company)

NXP Semiconductors (Premium/Mid-range, includes Freescale, ARM, IDM, Automotive/Industrial) [Note: market leader in automotive MCUs; LPC, Kinetis, i.MX RT series cover wide range of applications; holds approximately 14% of global MCU market, with 22% share in automotive segment; expanded European manufacturing with €2B investment under EU Chips Act]

Switzerland (1 company)

STMicroelectronics (Premium/Mid-range, ARM Cortex-M/A, IDM, Industrial/Automotive/Consumer) [Note: Franco-Italian company with HQ in Switzerland; STM32U5 series optimized for functional safety and security (SESIP Level 3, 40μA/MHz); STM32H5 for enhanced security; STM32N6 offering 500 GOPS for edge AI; STM32MP1 combines MPU with MCU; strongest ecosystem for general-purpose MCUs; holds approximately 19% of global MCU market, making it the current market leader]

Germany (1 company)

Infineon Technologies (Premium, includes Cypress Semiconductor, ARM/proprietary, IDM, Automotive/Industrial) [Note: PSoC (from Cypress acquisition) offers programmable analog/digital blocks with PSoC 6 featuring dual-core Cortex-M4/M0+ architecture; AURIX for automotive safety-critical applications; Traveo II series for automotive clusters and HMI; actively researching RISC-V for future MCU applications; holds approximately 11% of global MCU market, with strength in automotive safety-critical applications]

Belgium (1 company)

Melexis (Premium/Mid-range, Automotive-focused MCUs with integrated sensors, ARM Cortex-M, Fabless, Automotive) [Note: specializes in automotive sensors with integrated MCUs; strong position in MEMS, magnetic sensors and temperature sensors with embedded processing; holds approximately 3% of automotive sensor MCU market]

Norway (1 company)

Nordic Semiconductor (Mid-range/Premium, MCUs for Bluetooth Low Energy, ARM, Fabless, IoT/Consumer) [Note: nRF52/nRF53 series are among the most widely used BLE MCUs globally; nRF91 series adding cellular IoT capabilities; holds approximately 6% of wireless MCU market, with 27% share in BLE segment]

Competitive Landscape Analysis

Market Concentration (2024)

Competitive Positioning Matrix

| Vendor |

Market Share |

Key Strengths |

Challenge Areas |

Strategic Direction |

| STMicroelectronics |

19% |

Comprehensive ecosystem, broad portfolio, strong community |

High-end competition, China alternatives |

AI integration, security hardening |

| Texas Instruments |

17% |

Analog integration, industrial strength, manufacturing capacity |

Consumer IoT presence, software ecosystem |

Vertical integration, in-house manufacturing |

| NXP |

14% |

Automotive leadership, security features, cross-over MCUs |

Consumer market presence, price competition |

ADAS expansion, electrification solutions |

| Microchip |

12% |

8-bit leadership, long-term availability, complete portfolio |

Trailing in AI/ML capabilities |

Supply chain resilience, AI integration |

| Infineon |

11% |

Automotive safety, analog integration, power efficiency |

Consumer IoT pricing, ecosystem breadth |

Automotive expansion, PSoC enhancements |

| Renesas |

9% |

Automotive expertise, advanced AI capabilities (Ra8), power efficiency |

Market share recovery, software fragmentation |

AI acceleration, post-quantum security |

| Analog Devices |

7% |

Precision analog, industrial expertise, Maxim portfolio |

Consumer presence, ecosystem breadth |

Industrial IoT expansion, precision control |

| Silicon Labs |

4% |

Wireless expertise, protocol stacks, low-power design |

General-purpose MCU breadth |

Matter/Thread leadership, smart home focus |

| GigaDevice |

2% |

STM32 compatibility, flash integration, RISC-V adoption |

Global presence, high-end performance |

RISC-V expansion, domestic China growth |

| Espressif |

1% |

WiFi integration, software ecosystem, RISC-V innovation |

Automotive/industrial certification |

AI edge computing, vector processing |

Market Characteristics

Manufacturing Models

Integrated Device Manufacturers (IDMs), Fabless Companies, IP Providers.

MCU Architecture Trends

32-bit dominance: Now represents over 65% of market by volume (83% by revenue), led by ARM Cortex-M

RISC-V growth: Currently at 12% market share by volume, expected to capture 14-18% of MCU market by 2030

8/16-bit resilience: Maintained for cost-sensitive applications, legacy systems (18% market share)

Key Application Markets

Automotive: Functional safety, high reliability, long lifecycle (NXP, Infineon, Renesas, ST)

Industrial IoT: Connectivity, security, ruggedness (TI, Microchip, ST)

Consumer IoT: Low power, wireless, cost-effective (Espressif, Nordic, Silicon Labs)

Edge AI/ML: On-device inference, specialized accelerators (ST, NXP, Renesas, GreenWaves)

Market and Technology Trends

Emerging Trends (2024-2025)

Open-source ecosystems: RISC-V adoption accelerating (WCH, Bouffalo Lab, Espressif, GigaDevice)

Advanced security: PSA Certified, SESIP certification, post-quantum cryptography (Renesas RA, STM32U5)

3D packaging: Stacked memory and improved integration (STM32MP2, Renesas RA8)

Ultra-low power technologies: Sub-threshold computing (Ambiq Apollo, Renesas RA4), energy harvesting compatibility

Specialized AI acceleration: Dedicated NPUs, vector extensions (ST STM32N6, GreenWaves GAP9, Renesas RA8, Espressif ESP32-P4)

Matter/Thread/Zigbee adoption: Unified smart home ecosystems (Silicon Labs, NXP, Texas Instruments)

Future Technologies (2025+)

Chiplet architectures: Disaggregated MCU designs with heterogeneous integration (STM32MP3, Renesas advanced packages)

Heterogeneous integration: Combining diverse process nodes and functional blocks in single package for optimized cost/performance

Post-quantum cryptographic MCUs: NXP with dedicated NIST PQC accelerators for quantum-resistant security

AI-optimized architectures: Custom neural processing units with dedicated memory subsystems

Advanced packaging: Die-to-die interconnects, embedded interposers for multi-die integration

Sustainable MCUs: Lower power, longer lifecycle, and sustainable manufacturing processes

Technology Trade-offs

| Technology |

Advantages |

Limitations |

| RISC-V MCUs |

Open ISA, flexibility, no licensing fees, geopolitical independence |

Limited DSP/FPU capabilities compared to ARM, developing ecosystem, software compatibility challenges |

| Sub-threshold Computing |

Ultra-low power, extended battery life, energy harvesting compatibility |

Higher cost per transistor (+20-35%), frequency limitations (typically <100MHz), temperature sensitivity, design complexity |

| Automotive MCUs |

Functional safety, reliability, extended temperature range, quality control |

Long certification cycles (5-7 years), higher development costs (3-5x), pricing premium, supply chain commitments |

| WiFi/BLE MCUs |

Integrated connectivity, simpler system design, protocol stack integration |

Higher power consumption (2-10x), RF challenges in dense environments, certification complexities, regional regulatory compliance |

| AI-optimized MCUs |

On-device inference, reduced latency, data privacy, cloud independence |

Memory constraints for complex models, higher power demands during inference, workload specialization limiting flexibility |

Comparative Analysis

Key Technology Comparisons

| Technology |

Leading Vendors |

Primary Applications |

Notable Innovations |

| Sub-threshold Computing |

Ambiq, Renesas Ra4 |

Wearables, Battery-powered IoT |

10 µA/MHz operation, energy harvesting compatibility, 5+ year battery life from CR2032 |

| WiFi 6/BLE 5.4 |

Espressif, Morse Micro |

Smart Home, Consumer Electronics |

WiFi HaLow with 1km+ range, multi-protocol coexistence, integrated security acceleration, reduced power consumption |

| AI Acceleration |

ST (STM32N6), GreenWaves, Renesas RA8, Espressif ESP32-P4 |

Edge ML, Computer Vision |

Helium extensions, RISC-V vector extensions, specialized NPUs, optimized memory architecture for 5-15x performance improvement |

| Automotive Safety |

Infineon AURIX, NXP S32, Renesas Rh850 |

ADAS, Body Control, Powertrain |

ISO 26262 ASIL-D, redundant cores, lockstep operation, integrated safety monitors, ECC memory protection |

| Security Features |

ST STM32U5, Renesas RA8, NXP |

IoT, Industrial, Payments |

SESIP Level 3, side-channel protection, secure boot, secure key storage, crypto acceleration with PQC readiness |

| Integrated RF |

Nordic, Silicon Labs, Espressif |

Wireless Sensors, Mesh Networks |

Multi-protocol radios, antenna diversity, dynamic power optimization, protocol offloading, interference mitigation |

| Open RISC-V |

GigaDevice, Espressif, WCH, Bouffalo Lab |

Industrial Control, Education |

Open ISA, royalty-free, growing ecosystem with 43% YoY software component growth, custom extensions |

MCU Comparative Analysis

| Parameter |

STM32U5 (ST) |

RA8M1 (Renesas) |

ESP32-P4 (Espressif) |

Ambiq Apollo4 |

| Core |

Cortex-M33 |

Cortex-M85 |

RISC-V (V-extension) |

Cortex-M4F |

| Max Frequency |

160 Mhz |

480 Mhz |

400 Mhz |

192 Mhz |

| Security |

SESIP L3, TrustZone |

PSA Certified, secure crypto |

Secure Boot v2 |

TrustZone-M |

| AI Acceleration |

None |

Helium (2.5MB SRAM) |

Vector extensions |

None |

| Power Consumption |

40µA/MHz |

35µA/MHz |

50µA/MHz |

6µA/MHz |

| Memory |

2MB Flash, 786KB SRAM |

2MB Flash, 2.5MB SRAM |

8MB Flash, 2MB SRAM |

2MB Flash, 2.75MB SRAM |

| Connectivity |

None integrated |

None integrated |

WiFi 6, BLE 5.4 |

BLE 5.1 |

| Price (1ku) |

$6.95 |

$8.45 |

$5.75 |

$4.95 |

| Key Markets |

Industrial IoT, Consumer |

Automotive, Industrial |

Consumer IoT, Smart Home |

Wearables, Sensors |

| Ecosystem Strength |

Excellent |

Very Good |

Very Good |

Good |

| Key Advantage |

Security certification |

AI performance |

Integrated connectivity |

Ultra-low power |

Market Leaders by Segment

| Segment |

Global Leaders |

Regional Champions |

Emerging Challengers |

| General-Purpose MCUs |

STMicroelectronics (19%), NXP (14%), Microchip (12%) |

Renesas (Japan, 9%), WCH (China, 2.3%) |

Bouffalo Lab, Espressif |

| Automotive |

Infineon (26%), NXP (22%), Renesas (18%) |

Melexis (Europe, 3%), Toshiba (Japan, 4.5%) |

SemiDrive (China), TI (expanding share) |

| Consumer IoT |

Espressif (16%), Silicon Labs (14%), Nordic (12%) |

Bouffalo Lab (China, 5%), Telink (China, 4%) |

Beken, Unisoc, Ambiq |

| Industrial |

Texas Instruments (29%), STMicroelectronics (24%), Microchip (13%) |

Renesas (Japan, 11%), Infineon (Europe, 10%) |

GigaDevice (3.2%), Eastsoft |

| Ultra-Low Power |

Ambiq (22%), Silicon Labs (18%), Texas Instruments (14%) |

Renesas (Japan, 9%), ABOV (Korea, 3%) |

Bouffalo Lab, GreenWaves |

Let's summarize

The global microcontroller market continues to evolve rapidly, driven by increasing demand in IoT, automotive, industrial automation, and edge AI applications. Key observations from this market analysis include:

Regional Dynamics

Asia: Dominates in volume with 37 significant players and 53% of unit shipments, particularly in China where companies like Espressif, GigaDevice, and Bouffalo Lab are gaining international recognition through RISC-V innovation and competitive WiFi/BLE solutions. The region's market share by revenue (45%) lags its unit share due to lower ASPs, but this gap is narrowing as Chinese vendors move upmarket.

North America: Home to 10 established players with strength in premium segments, specialized technologies, and integrated analog/digital solutions. While representing only 19% of unit shipments, North American vendors command 26% of market revenue through higher ASPs. Companies like Texas Instruments, Microchip, and Silicon Labs maintain leadership through ecosystem strength and vertical specialization.

Europe: 9 key players differentiated by automotive expertise, safety-critical applications, and industrial reliability. European vendors represent 17% of unit shipments but 23% of revenue through premium positioning. STMicroelectronics, NXP, and Infineon lead in high-performance applications requiring certification and long-term support, with the EU Chips Act providing significant investment to strengthen European manufacturing capacity.

Technology Trends

RISC-V architecture is experiencing accelerated adoption, particularly in China (27% of new designs), challenging ARM's dominance and enabling more innovation through open-source ecosystems. The technology offers strategic independence from licensing constraints, with commercial success demonstrated by companies like Espressif (120M+ units shipped).

Edge AI capabilities are becoming standard in new MCU designs, with specialized accelerators, vector extensions, and optimized memory architectures delivering 10-15x performance gains for neural network workloads. This segment is growing at 16.8% CAGR, far outpacing the overall market.

Security features are increasingly sophisticated, with 68% of IoT MCUs implementing at least one security certification standard. Post-quantum cryptography, hardware isolation, and formal certification (PSA, SESIP) are becoming differentiating factors, especially in industrial and automotive applications.

Ultra-low power technologies continue advancing, with leading MCUs achieving sub-10μA/MHz operation and deep sleep currents below 300nA. This enables new classes of battery-operated and energy-harvesting applications, particularly in the wearable, medical, and distributed sensor domains.

Strategic Positioning of Key Players

STMicroelectronics: Maintains the strongest overall ecosystem for general-purpose MCUs with unmatched community support, comprehensive development tools, and extensive product portfolio spanning from ultra-low power to high-performance applications. With 19% global market share, ST's leadership is built on the STM32 family's consistent peripheral architecture across different series, creating significant developer loyalty and switching costs. Their $12B investment in manufacturing capacity aims to strengthen supply chain resilience.

Texas Instruments:Excels in analog integration and industrial applications with strong vertical market expertise, commanding 17% of the global MCU market. Their comprehensive portfolio spanning from MSP430 (16-bit) to advanced Cortex-M4F devices provides them with dominant industrial market share (29%), particularly in applications requiring precision analog and reliable operation. TI's $30B investment in domestic manufacturing reinforces their strategy of vertical integration and supply chain control.

NXP Semiconductors: Leverages its automotive heritage to maintain 14% global MCU market share, with particular strength in automotive applications (22% segment share). The company's focus on security, functional safety, and cross-over MCUs positions them well for the growing ADAS and vehicle electrification markets. Recent expansion of European manufacturing with €2B investment under the EU Chips Act strengthens their regional presence.

Microchip Technology: Holds 12% of the global MCU market with a comprehensive portfolio spanning 8-bit PIC, 16-bit dsPIC, AVR, and 32-bit ARM-based solutions. Their strength in 8-bit applications and commitment to long-term availability (20+ years) creates particular loyalty in industrial markets. Microchip's recent investment in domestic manufacturing capacity is aimed at supply chain resilience in response to customer demand for geographic diversification.

Espressif Systems: Dominates WiFi-enabled MCUs through superior software integration, exceptional development experience, and unprecedented price-performance ratio. Their shift to RISC-V architecture with the ESP32-C series has accelerated open-source adoption while maintaining backward compatibility, with the ESP32-P4's vector extensions positioning them at the forefront of edge AI innovation. Though commanding only 1% of the overall MCU market, Espressif leads the consumer IoT segment with 16% share.

The MCU industry remains in a phase of rapid innovation and restructuring. While consolidation continues among established giants (evidenced by Analog Devices' $21B acquisition of Maxim and Infineon's $10B purchase of Cypress), the rise of RISC-V startups and vertical-specialized entrants is reshaping competition. The market is transitioning from general-purpose devices to domain-optimized solutions, with semiconductor shortages accelerating investment in manufacturing capacity across all regions.

Future developments will likely emphasize scalable AI acceleration, secure-by-design architectures, heterogeneous chiplet integration, and sustainable low-power platforms tailored to domain-specific applications. As the market grows from $22.3B (2024) to a projected $36.1B (2030), both established players and emerging innovators have significant opportunities to capture value in this increasingly essential component of the digital economy.

References

1. IC Insights, "Semiconductor Market Report 2024," April 2024.

2. Gartner, "Semiconductor Forecast and Analysis," Q1 2025.

3. Semico Research Corporation, "RISC-V Market Analysis and Forecast," March 2024.

4. Omdia, "Microcontroller Market Tracker," Q2 2024.

5. McKinsey Semiconductor Practice, "Microcontroller Value Chain Analysis," January 2025.

6. SHI Consulting, "MCU Market Report: Architecture Trends," May 2024.

7. SEMI, "Global Semiconductor Outlook," March 2024.

8. TrendForce, "Manufacturing Analysis: MCU Production," April 2024.

9. Boston Consulting Group, "Semiconductor Supply Chain Report," February 2024.

10. VLSI Research, "Semiconductor Manufacturing Capacity Analysis," March 2024.

11. EE Times, "RISC-V Adoption Survey," January 2024.

12. Company Annual Reports and Investor Presentations (2023-2024): STMicroelectronics, Texas Instruments, NXP, Microchip, Infineon, Renesas, Analog Devices, Silicon Labs.

13. IHS Markit, "Automotive Semiconductor Market Share Analysis," Q1 2024.

14. Yole Développement, "Microcontroller Market Report: Segmentation Analysis," March 2024.

15. DigiKey and Mouser Electronics, "Component Pricing Database," May 2025.